A Checklist for Aspiring Farmers

go.ncsu.edu/readext?994644

en Español / em Português

El inglés es el idioma de control de esta página. En la medida en que haya algún conflicto entre la traducción al inglés y la traducción, el inglés prevalece.

Al hacer clic en el enlace de traducción se activa un servicio de traducción gratuito para convertir la página al español. Al igual que con cualquier traducción por Internet, la conversión no es sensible al contexto y puede que no traduzca el texto en su significado original. NC State Extension no garantiza la exactitud del texto traducido. Por favor, tenga en cuenta que algunas aplicaciones y/o servicios pueden no funcionar como se espera cuando se traducen.

Português

Inglês é o idioma de controle desta página. Na medida que haja algum conflito entre o texto original em Inglês e a tradução, o Inglês prevalece.

Ao clicar no link de tradução, um serviço gratuito de tradução será ativado para converter a página para o Português. Como em qualquer tradução pela internet, a conversão não é sensivel ao contexto e pode não ocorrer a tradução para o significado orginal. O serviço de Extensão da Carolina do Norte (NC State Extension) não garante a exatidão do texto traduzido. Por favor, observe que algumas funções ou serviços podem não funcionar como esperado após a tradução.

English

English is the controlling language of this page. To the extent there is any conflict between the English text and the translation, English controls.

Clicking on the translation link activates a free translation service to convert the page to Spanish. As with any Internet translation, the conversion is not context-sensitive and may not translate the text to its original meaning. NC State Extension does not guarantee the accuracy of the translated text. Please note that some applications and/or services may not function as expected when translated.

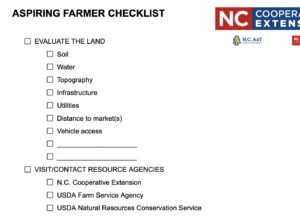

Collapse ▲While this checklist is presented with some thought as to chronology, each situation is different and the order of operations will vary. Some information will not be applicable in states other than North Carolina. Further, due to the complexity of starting a farm and the variability of each situation, this list (and likely any other) is incomplete.

Evaluate your land – If you have already purchased, inherited, leased, borrowed or otherwise honestly gained access to land, spend some time evaluating its resources and potential. If you have not yet obtained access to land, then make every effort to thoroughly evaluate potential parcels prior to signing a purchase or lease agreement. Resources to evaluate include, among others, soil, water, topography, existing infrastructure (e.g. buildings, fencing), utilities, distance to markets, zoning restrictions and vehicle access. For additional information, see How to Evaluate Land for a Small Farm.

Decide whether/when to apply for the Present Use Tax program (if applicable) – This program, authorized by state law and administered by the county tax office, can reduce the amount paid for property taxes. When purchasing land that qualifies for this program, there is a 60 day window after purchase to enroll. Otherwise, a four year waiting period goes into effect. There may be an advantage to waiting. For more information see Present Use Value: The Basics.

Decide whether/when to apply for a Sales Tax Exemption Certificate – North Carolina Farmers who qualify are exempt from paying sales tax on certain farm supplies and equipment. This program is administered by the North Carolina Department of Revenue. Consider carefully, as there may be an advantage to delaying the application to a future time. For more information, see Farm Sales Tax and Exemptions.

Visit your local N.C. Cooperative Extension County Center – Meet the Ag Extension Agent(s) and other staff. Ask about learning opportunities, production guides & technical assistance. Ask to be placed on their mailing list. Visit the website for your local Cooperative Extension Center, as well as the “topic” portals. Consider subscribing to topics of interest.

Visit your local USDA Farm Service Agency – Meet the staff, learn about their programs & consider getting a farm number. This agency administers a variety of cost share, loan and other programs that benefit farmers, some of which are specifically designed for beginning farmers. Here’s the USDA Service Center Locator.

Visit your local USDA Natural Resources Conservation Service office – Meet the staff, learn about their programs. This agency also administers cost share programs, focused on protecting environmental resources. Often co-located with the Farm Service Agency (above) and Soil & Water office (below).

Visit your local Soil & Water Conservation District office – Meet the staff, learn about their programs. This state/local agency provides cost share and technical assistance around protecting (surprise!) soil and water resources. Find your local Soil & Water office.

Decide what to grow/raise – This decision should be based on physical characteristics of your land, amount you have to invest, profit expectations, personal passion and extensive market research. In my opinion, “extensive market research” is a months-long process that cannot be adequately performed solely using the internet. This step should go hand in hand with the step below, “Develop a business plan”. For more insight, see see this hypothetical exercise in deciding what to grow.

Develop a business plan – This may be the most important task on this list. Even if profit is not a primary motivation, a detailed business plan can help quantify startup costs, operating costs, product pricing and other important financial variables. Help is available through NC Farm School, the Small Business Center at your local community college and elsewhere.

Develop a system to track farm income & expenses – These may need to be reported on your income tax return. For more information, contact your tax professional, or search for the topic at the IRS website.

Learn about collecting sales tax – In some cases sales taxes must be collected on the sale of farm products, but not in others. Additionally, the rate can vary depending on several factors. Details are available from the NC Department of Revenue. For more information, see Farm Sales Tax and Exemptions.

Learn about rules/regulations – A variety of local, state and federal regulations are applicable to a farming operation. Such regulations may impact the production, processing and/or sale of the products you want to produce. Your Ag Extension Agent can help. Learn more about regulations impacting farmers.

Evaluate (and mitigate) liability risks – There are a variety of liability risks associated with a farm operation, such as a visitor or worker getting injured, a product causing illness, or an escaped farm animal causing a vehicle crash. Liability risks can be mitigated through insurance, practices (e.g. sanitizing equipment), infrastructure (e.g. proper fencing), signage, training, creating a business entity, etc.

Begin production – Be prepared for a steep, multi-season learning curve, countless frustrations, long hours and many failures. Also be prepared for deeply fulfilling experiences and immeasurable joys.